Hello! Welcome to Cashflow Connect. This is the first of a series on personal finance, where we interview a diverse group on their spending habits and their opinions on money. We explore the experiences that have shaped their worldview and the incentives behind their goals.

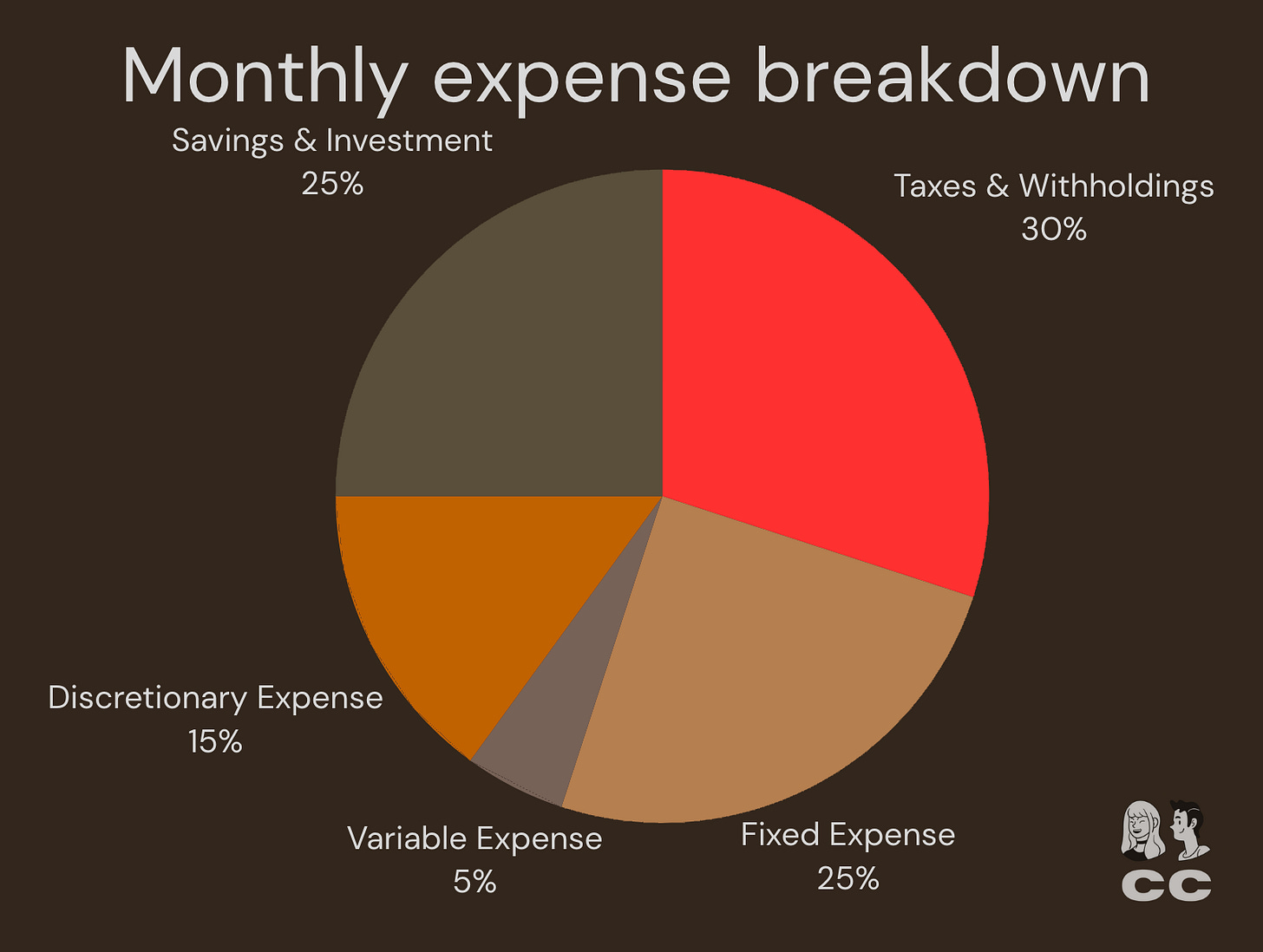

Our subject for today, let’s call him “Jay“, is an early career software engineer based in the New York Metropolitan area. Here’s a high-level breakdown of his expenses.

Our conversation with Jay surfaced the vulnerability involved in talking about your personal finances, and the emotional ties that come with taking responsibility for them.

Who is Jay?

Jay, 24, split his childhood between the US and India, completing most of his education, including an undergraduate degree, in India.

Graduating during the pandemic, unsure of next steps, he decided to pursue an online Master’s in Data Science from a US university.

His annual income ranges between $150,000 - $200,000, earned solely from his job as a Software Engineer (exact figures intentionally undisclosed in this publication, pre-tax). Jay lives with roommates to keep living expenses low.

The effects that the pandemic had in early 2020 are still fresh in the minds of many Americans.

Investing

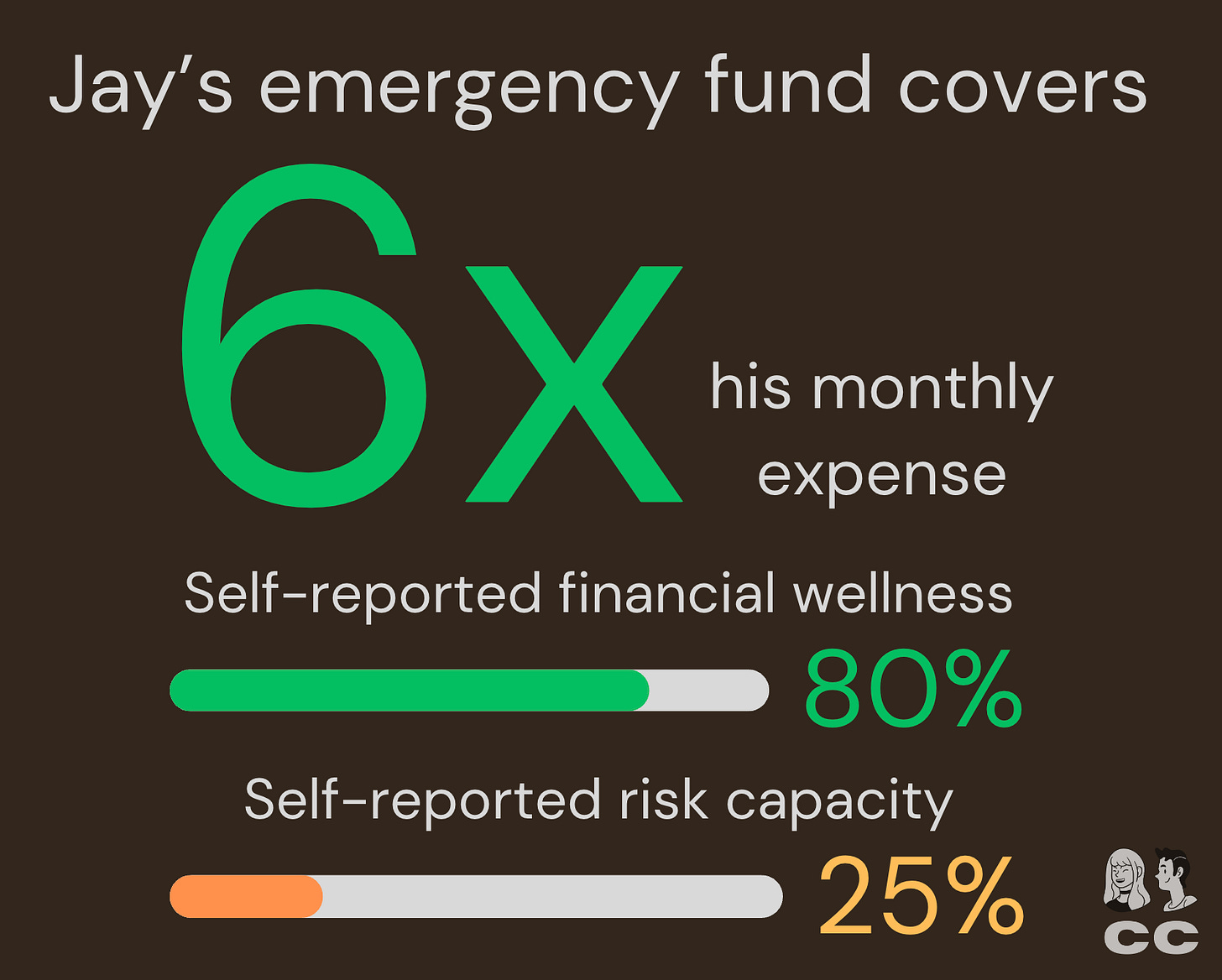

Jay’s company provides a 401(k) that he regularly invests in, but doesn’t necessarily keep tabs on how that money is invested. Fortunately, Jay earns enough to be one of the 11% of Americans with 401(k)s who contribute the maximum amount annually. But he’s unwilling to start investing in the market apart from that.

This is a classic example of the tension between effort and reward when it comes to taking concrete steps towards financial wellness. Unlike many out there, he is wary of being in a position where his hard earned money can be wiped away by a volatile market.

While it is true that investing can be risky, there is a difference between blindly trusting the market thinking it can go nowhere but up - and taking a calculated risk, based on research from sources you trust, and your risk appetite. A healthy suspicion of the credibility of advice out there is good (where are all the crypto influencers now?), but at some point, sticking your money under the mattress starts to hurt you.

The “fun” part of being Gen Z is not just that we graduated into a pandemic-era stock market; we also had the childhood joy of watching the housing bubble burst, so a general distrust seems warranted. The market effects of the pandemic in early 2020 are still fresh in the minds of many Americans.

In the current tech job space, Jay also worries about job security. He feels as though sticking his money in an investment account takes it out of his reach and places it in the hands of forces he doesn’t trust.

He recognizes that there are avenues to grow his funds that will still allow him to access them, like CDs or High-Yield Savings Accounts. However, he admits to facing some amount of friction to starting the process, something he chalks up to procrastination.

Procrastination

It’s a curious word to describe what many of us feel when it comes to meeting concrete financial goals. So why do we hear it so often?

It can be extremely hard to visualize a clear role for your money, especially when you’re young and early career

The motivation to formalize these goals is extremely low when there just isn’t enough money to go around

And when you actually want to take a step forward - there’s a firehose of information out there that can be hard to wrap your head around

For those of you who are regularly engaged in the pursuit of your financial goals, you know how hard it can be, and many people look to communities to get answers. (Shoutout to r/PersonalFinance)

All these factors, and the threat of a market downturn (or maybe not?), continue to impact his appetite for risk, and his willingness to invest.

Like a many of you out there, he doesn’t think it’s important to have set plans for your money, especially when it could all fall apart at any moment.

Budgeting and Debt

Jay checks his bank account a few times a week, usually when planning for the weekend. Once on Wednesday - leading up to any set plans, and then after the weekend - to check the damage. Keeping track of his accounts is less about restriction or sticking to a budget; it’s more of a sanity check.

Jay is currently debt-free, and is extremely careful about taking on new debt or spending on high-cost items. This reflects the trend in consumer spending in October 2023 (We’re writing this in November), as sustained pressure from high inflation, rising costs of gas and food, and overall budget tightening have slowed spending.

While recognizing that there are perks to taking on certain debt, like a mortgage (with less absurd interest rates), Jay, like many others, has developed a healthy cynicism towards taking on new debt.

Goals

Jay’s willingness to admit that he doesn’t really have any plans for his money was the most relatable point for us. He’s very early in his career, has already built up an emergency fund, and is living in one of the most expensive cities in the world, all during an especially difficult economic climate.

Like many of you out there, he doesn’t think it’s important to have set plans for your money, especially when it could all fall apart at any moment.

At this point, he’s chosen to continue contributing to his savings, a safe and low-effort step.

If you have some advice for Jay, put it down below! We’re not experts, and we want to bring these stories to a community that cares.

Contribute to our research here.

Outro

Jay usually learns about managing finances and investing from his conversations with friends, but tends to verify what he hears before accepting any opinions.

More recently, conversations about future goals have him thinking that there are steps he can take to secure his future. He admits to not knowing enough about what to do, but it hasn’t been enough of a stressor to spur him into action.

We urge you all to take the steps you can today.

A comprehensive guide to get started can be found on Nerdwallet, but here are a few high level pointers:

Take advantage of risk-free investments, like CDs, or opening a High-Yield Savings Account. (Learn more about FDIC Insurance)

Contribute to your retirement funds, at least enough to get your employer match.

Prioritize paying off your highest interest loans.

Ask your questions in the comment section below!

If you would like to be featured on this publication, reach out to join the waitlist;

We would love to tell your story!

Thank you for reading.

See you next week.

Disclaimer: The information provided in this newsletter is for educational and informational purposes only. It is not intended as and should not be considered financial, investment, or legal advice. The content is general in nature and may not be applicable to your specific circumstances. Always consult with a qualified professional for advice tailored to your individual situation. The authors and publishers of this newsletter are not financial experts, and any actions taken based on the information presented are at the reader's own risk. We do not endorse or recommend any specific financial products or services. Any reference to third-party websites or products does not constitute an endorsement. The accuracy, completeness, or reliability of information provided cannot be guaranteed. Readers are encouraged to conduct their own research and seek professional advice if needed.