Decoding Debt 💸

Credit, leverage, and strategies

Hello! Welcome to Cashflow Connect. This is a series on financial wellness, where we cater to a diverse group, on topics ranging from mastering spending habits to unraveling the intricacies of capital. We explore the experiences that shape worldviews and the incentives behind common financial goals.

Most of us are familiar with debt in some form. Be it student loans or credit cards, debt is an integral part of our lives.

But what does it actually mean to take on debt? In this feature, we will dive into some of the common aspects of debt, how the various types differ, and how to evaluate whether a debt transaction is in your best interest.

Want to listen to this feature? Scroll to the bottom to find the voiceover. Or listen on Spotify.

Is this Debt?

There are a few key features that helps us identify whether a transaction we’re making has a debt component.

To keep it simple, a debt transaction involves two parties:

The debtor, or the one who receives money, goods and/or services, and

The creditor, the one who provides money, goods and/or services.

The transaction is a financial obligation for the debtor, who typically will:

Owe the value of the borrowed amount,

and the cost of borrowing that amount, typically in the form of interest.

To be repaid on a pre-determined schedule,

Over a pre-determined duration.

Clearly, owing a friend for dinner is not debt, but a Student Loan for:

<a ridiculous amount of money for college>

with a 9% interest rate,

To be paid monthly,

Over 10 years.

is definitely debt.

Most of these factors are pretty straightforward to understand. Interest, however, is typically a black box for most of us.

For creditors, giving out loans should have a good reason, especially when there are safer investment options. This is why interest rates on debt are usually higher than a “benchmark” interest rate. US Treasuries - debt that the US government takes on - are widely regarded to be the safest investment. Why? The US has a history of paying its debts, due to reasons like the strength of the economy, a stable political system, and sound monetary policies. The benchmark interest rate for a debt transaction is then the Treasury rate, or the “risk-free” rate.

Simply put, the debt transaction is a liability for the debtor, but an asset for the creditor. However, this asset is only realized if the debtor continues making the scheduled repayments, or does not “default”. When repayment is dependent on the debtor, there is a certain amount of risk that creditor takes on, called “Default Risk”.

This risk is influenced by the debtor’s “credit-worthiness” - their track record of past debt transactions with other creditors. A good track record implies that the next creditor can have a high degree of confidence in receiving their repayment; hence they take on low risk, and charge a lower rate of interest (and vice versa).

Credit is the ability to borrow, and debt is the result of borrowing.

There are also other types of costs associated with a debt transaction, the simplest being the administrative cost of providing financial services. Conducting credit risk assessments, accounting for inflation and unexpected changes in the market also contribute to the overall interest rate quoted for a debt transaction.

A “risk premium” is added to the risk-free rate to account for all of these risks, including Default Risk, and costs.

Charging interest ensures creditors are adequately compensated for providing capital and taking on risk.

There is most definitely a profit component included here as well, which is where most debtors find a window to negotiate.

You have been deemed worthy

What does it mean to be credit-worthy? As we saw, credit-worthiness is simply a formal way to communicate to creditors in the marketplace that you are financially responsible, have a history of being reliable with payments, and that the Default Risk associated with allowing you to borrow money is relatively low.

Because of the many ways that this can be demonstrated, the US follows a standardized measure of credit-worthiness called a Credit Score.

The system of evaluating credit-worthiness is relatively new, and has only been in place since 1989, when the Fair Isaac Corporation, known today as FICO, introduced the credit score model. Before then, evaluating an individual’s credit score was based on character references, local credit bureaus, interviews, and personal investigations with local merchants and businesses. The introduction of FICO provided a standard and an automated evaluation method.

It’s worth noting that the FICO model has undergone several updates and revisions to enhance its predictive accuracy and adapt to changing economic conditions. Today, there are different models specific to Auto Loans, Credit Cards (FICO Bankcard Score), and Mortgages.

FICO uses statistical models that consider the following aspects of an individual’s credit history:

Payment History (35%): This is the record of your payments on credit accounts, including credit cards, mortgages, and other loans. Timely payments positively impact your score, while late payments, defaults, and bankruptcies have negative effects.

Credit Utilization (30%): This refers to the ratio of your current credit card balances to your credit limits. A lower ratio is better, as it suggests responsible credit management.

Length of Credit History (15%): This considers how long your credit accounts have been active. A longer credit history is beneficial for your score.

Types of Credit in Use (10%): This accounts for the variety of credit accounts you have, including credit cards, mortgages, and installment loans. A diverse mix may positively influence your score.

New Credit (10%): Opening multiple new credit accounts within a short period can be seen as a risk. Credit inquiries (hard inquiries) made by lenders when you apply for credit can also impact your score, although inquiries within a short timeframe for the same type of loan (like a mortgage) are often treated as a single inquiry.

These are then used to generate a numerical representation.

Credit Bureaus are organizations that collect information regarding credit usage of individuals, and use models to make Credit Scores available to both individuals and creditors. Experian, Equifax, and TransUnion are the three major credit bureaus, but there are several smaller and local ones as well.

A good credit score is a signal to creditors that the debtor’s Default Risk is low, and they can can charge a lower risk premium, and hence a lower interest rate.

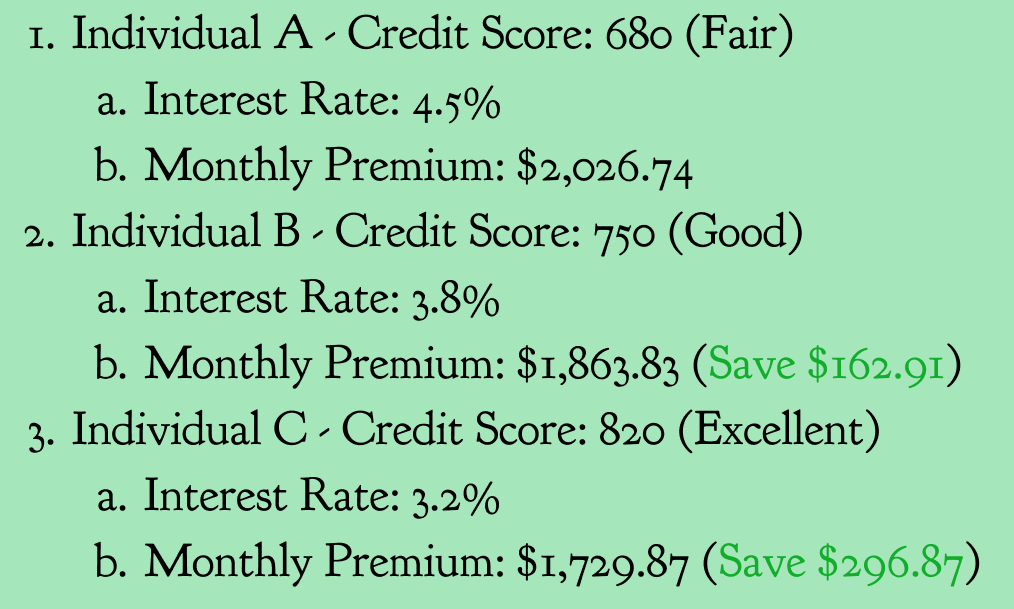

As an example, let's look at the monthly premium that three individuals, each securing a home loan of $400,000, will be required to pay:

Demonstrating Credit-worthiness

To take advantage of the credit system, and gain favorable rates on debt, it’s of paramount importance to set yourself up for success.

There are two types of debt, secured or unsecured. Secured debt is typically easier to qualify for if you’re just starting out. When you take on secured debt, you provide an asset, called “collateral”, that is pledged to the creditor in case you are unable to pay it back. This significantly reduces the amount that the creditor risks losing in case of default, as they can sell the asset to recoup their money.

This is a widely utilized strategy for Auto Loans, where the creditor places a claim of ownership, or a “lien” on your car, that they can exercise to possess your car if you fail to make repayments.

Collateralized debt doesn’t always refer to large loans, like home loans, or auto loans.

For students, or those with lower cash on hand, a secured credit card is a great way to start building your credit history and build your credit-worthiness. To get a secured credit card, you make a cash deposit, called a “Security Deposit” to the issuing bank to get a card with a limit that corresponds to the amount you paid.

Over time, responsible usage of your credit card builds your credit profile, and you may get your initial deposit back if you qualify for unsecured credit. Most well known regular credit cards are unsecured.

With other unsecured debt transactions, it’s easy to see that the creditor takes on significantly higher risk by lending. This is the reason why unsecured loans have higher interest rates.

Types of Debt

The concept of collateral is one way we can classify debt, as secured or otherwise. There are also other ways to categorize the type of debt you are taking on.

Revolving vs Installment

This classification has to do with the type of credit that you utilize to take on debt.

An open-ended credit line is one where you can can borrow the amount you require at any time up to an established limit. If you repay the amount you borrow, then you can reuse it to borrow more, as many times as you wish - hence the name “revolving” debt.

Credit Cards are the most common example of this type of credit, and are unsecured. A Home Equity Line of Credit (HELOC), is a secured line of open-ended credit, collateralized by your home. You can choose to utilize this kind of credit to borrow a required amount for large projects, like renovations.

A closed-ended credit line is one where you have to explicitly qualify for that particular debt transaction - and for a set amount. You then get a lump sum, which you pay off in installments according to a set repayment schedule until your obligation is complete - hence the name “installment” debt.

A Home Equity Loan (HEL) is debt that you take on based on a secured line of closed-end credit, collateralized by your home.

Installment debt is almost always taken on for a specific purpose - like buying a home, or education - while revolving debt can be used for varying purposes.

Fixed Rate vs Variable Rate

This classification is based on the interest rate associated with your debt transaction. A fixed interest rate on debt gives debtors predictability and stability in their monthly payments, and is largely preferred.

Home loans are typically issued with fixed interest rates.

Variable interest rates change according to market conditions, which introduces uncertainty for debtors, and many tend to stay away from taking on debt of this type. However, a compelling reason to take on this kind of debt is if you believe economic conditions will improve, and in turn, reduce your interest rate in the future.

HELOCs are typically issued with variable interest rates.

There are more classifications for debt that are utilized at higher levels, like debt transactions by businesses, or corporate bonds, but they’re not usually relevant for individuals.

Outro

Debt is an essential part of personal finance, as it can provide valuable leverage for individuals to obtain the assets they need, like homes and education.

While it might seem commonplace in a mature economy like the US, credit is not as widely available in most developing parts of the world. Debt products also do not have as many sophisticated types to choose from.

From a wider economic perspective, a stable financial market, and a positive growth outlook can increase the availability of credit and debt. This is turn stimulates spending on necessary assets, enabling class mobility for many population groups.

However, it’s vital to manage debt responsibly.

In the US, you have the right to request a free credit report from each of the three major credit bureaus once a year, through AnnualCreditReport.com. Reviewing these reports is essential for monitoring one's credit history, checking for inaccuracies, and understanding how credit-related activities may be affecting credit scores.

Start with secured, revolving, fixed-rate credit, like a secured credit card, to build your credit-worthiness. Then start using unsecured, revolving credit, like most regular credit cards. This is turn helps with gaining favorable terms for larger debt, like unsecured, installment-based Home Equity Loans or Student Loans. As you take on more kinds of debt, and manage them well, your credit-worthiness keeps improving.

There are ways to start building your credit history early, like becoming an authorized user on a family member’s credit card, and is a great option if it is available to you.

Mismanaging your debts, on the other hand, can lead to significant consequences, like losing collateralized assets, being disqualified from certain types of credit due to a low credit score, and being locked out of a system that can enable upward mobility.

Voiceover

If you have any questions, please leave a comment below.

If you would like to be featured on this publication, reach out to join the waitlist;

We would love to tell your story!

Thank you for reading, see you next time.

Disclaimer: The information provided in this newsletter is for educational and informational purposes only. It is not intended as and should not be considered financial, investment, or legal advice. The content is general in nature and may not be applicable to your specific circumstances. Always consult with a qualified professional for advice tailored to your individual situation. The authors and publishers of this newsletter are not financial experts, and any actions taken based on the information presented are at the reader's own risk. We do not endorse or recommend any specific financial products or services. Any reference to third-party websites or products does not constitute an endorsement. The accuracy, completeness, or reliability of information provided cannot be guaranteed. Readers are encouraged to conduct their own research and seek professional advice if needed.